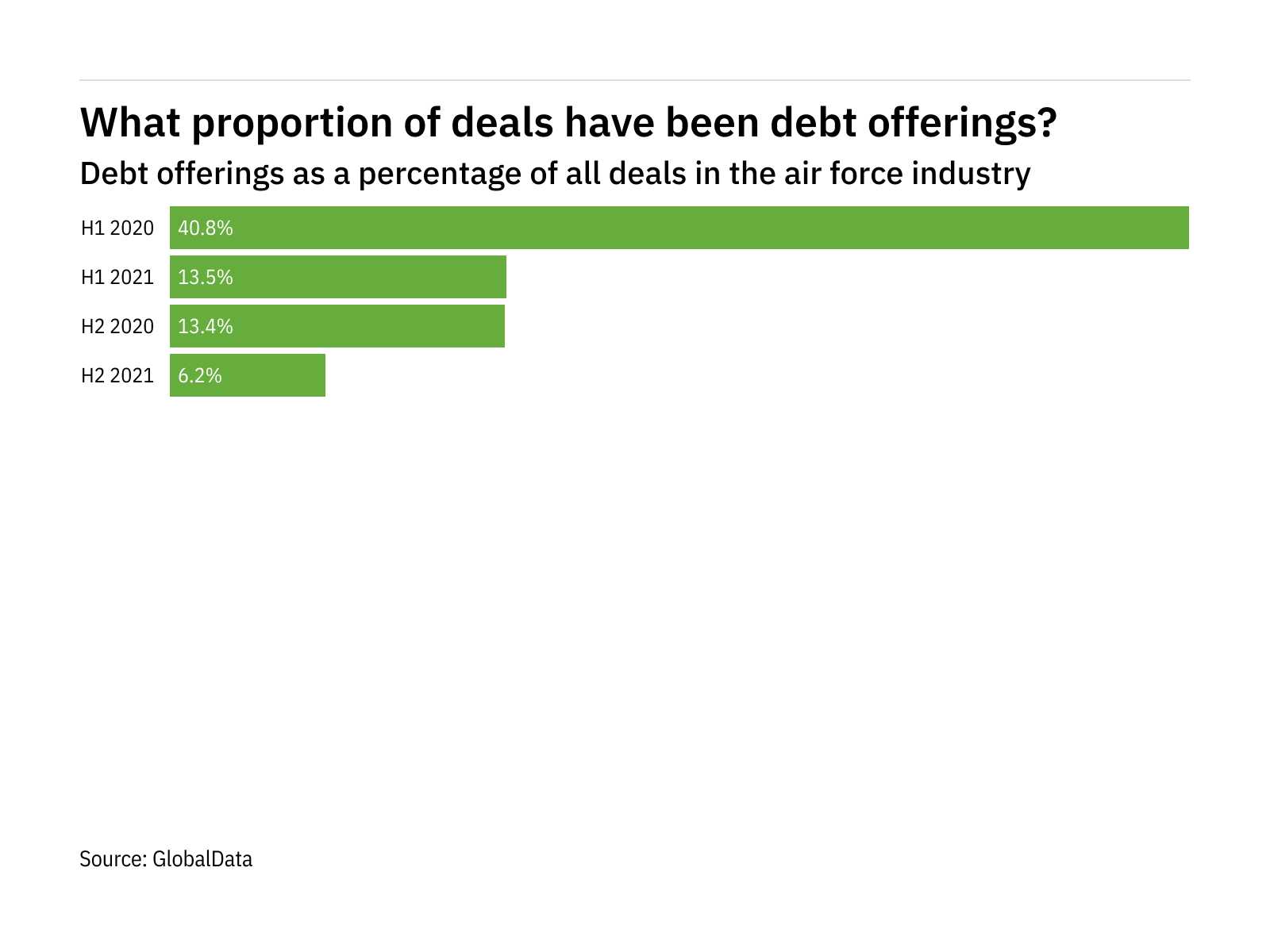

In the second half of 2021 the number of debt offerings decreased significantly by 66.7% from the same period in 2020.

This marks an acceleration in growth from the 75.9% decrease in deals that occurred in H1 2021 relative to the same period a year earlier.

During second half of 2021, debt offerings accounted for 6.2% of all deals taking place in the sector. This represents a decrease from the figure of 13.4% in second half of 2020.

GlobalData's deals database is a comprehensive repository that looks at mergers, acquisitions, venture financing, equity offerings, asset transactions, partnerships and debt offerings taking place daily between thousands of companies across the world.

The database details key deal information, such as deal summary, deal rationale, deal financials, parties involved, advisors and deal payment modes.

By tracking the proportion of various types of deals in each sector we can gauge which sectors are seeing growth and where others are struggling.

The highest value debt offering announced in 2021 (where the deal value was known), is the funds to be raised by Rolls-Royce Holdings in a bond offering.

The debt offering is set to be worth $1287.1 million.